business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

Introduction In the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.

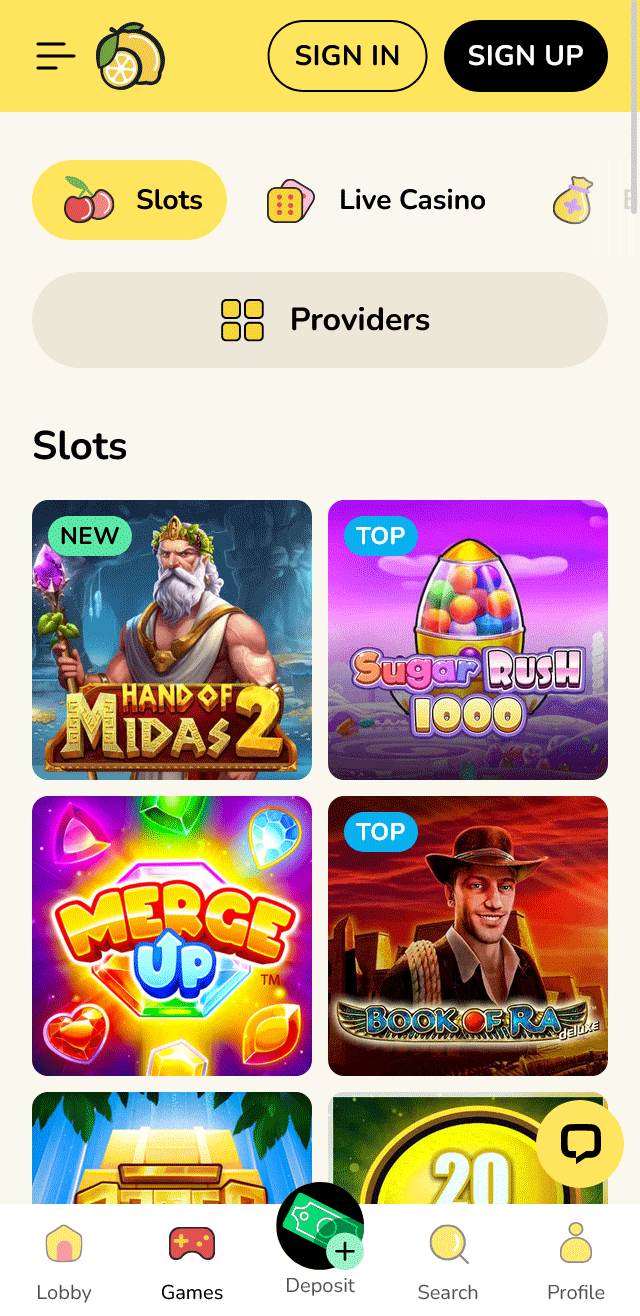

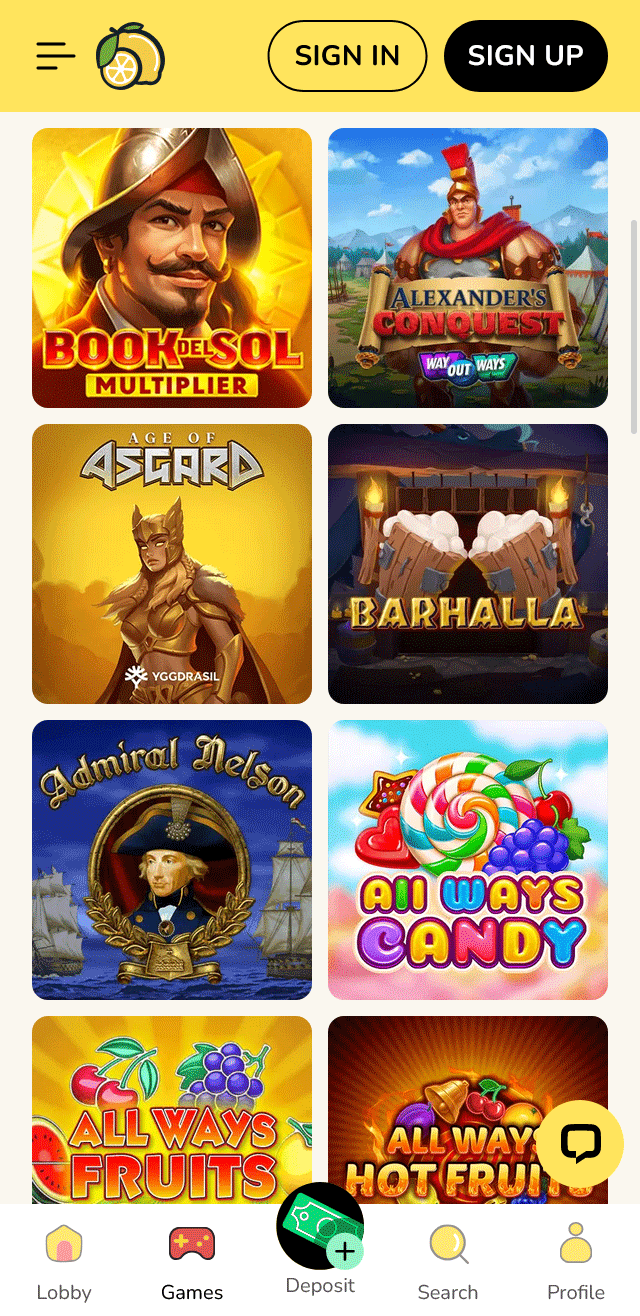

- Lucky Ace PalaceShow more

- Cash King PalaceShow more

- Starlight Betting LoungeShow more

- Golden Spin CasinoShow more

- Spin Palace CasinoShow more

- Silver Fox SlotsShow more

- Lucky Ace CasinoShow more

- Diamond Crown CasinoShow more

- Royal Fortune GamingShow more

- Royal Flush LoungeShow more

business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

Introduction

In the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.

Understanding Wealth Tax

What is Wealth Tax?

Wealth tax is a levy imposed on the net wealth of individuals and companies. It is calculated based on the value of assets owned, including real estate, financial investments, and business assets. In the context of online casinos, wealth tax can apply to the profits generated by players and the revenue earned by the casino operators.

Wealth Tax in India

In India, wealth tax was abolished in 2016, but the concept of taxing wealth remains relevant in the form of other taxes such as income tax and capital gains tax. For online casino operators and high-net-worth players, understanding the tax implications is crucial to ensure compliance and avoid legal issues.

Business Game Rules in Indian Online Casinos

Types of Games

Indian online casinos offer a variety of games, including:

- Baccarat: A card game where players bet on the hand they believe will be closest to nine.

- Electronic Slot Machines: Digital versions of traditional slot machines, offering various themes and payout structures.

- Football Betting: Betting on football matches, including pre-match and live betting options.

- Casino Games: Classic casino games like poker, roulette, and blackjack.

Rules and Regulations

- Age Restriction: Players must be at least 18 years old to participate in online casino games.

- Licensing: Online casinos must be licensed by the relevant authorities to operate legally in India.

- Responsible Gaming: Casinos are required to promote responsible gaming and provide resources for problem gambling.

- Payment Methods: Secure and legal payment methods must be available for deposits and withdrawals.

Wealth Tax Considerations for Players

Reporting Winnings

Players must report their winnings from online casinos as income. This includes:

- Tournament Winnings: Prize money from casino tournaments.

- Jackpot Wins: Large payouts from slot machines or other games.

- Regular Wins: Consistent winnings over time.

Tax Implications

- Income Tax: Winnings are subject to income tax, which varies based on the player’s tax bracket.

- Capital Gains Tax: If winnings are considered capital gains, they may be subject to a different tax rate.

- Deductions: Players can deduct losses from their winnings to reduce taxable income.

Wealth Tax Considerations for Casino Operators

Revenue Reporting

Casino operators must report their revenue accurately to the tax authorities. This includes:

- Gross Revenue: Total income generated from all games and services.

- Operating Costs: Deductions for operational expenses such as salaries, marketing, and technology.

- Profit: Net profit after deducting operating costs from gross revenue.

Tax Compliance

- Income Tax: Operators must pay income tax on their net profit.

- GST: Goods and Services Tax (GST) applies to the services provided by the casino.

- Audit: Regular audits by tax authorities ensure compliance with tax laws.

The business game rules in Indian online casinos, particularly in Mumbai, are governed by a complex interplay of regulations and tax laws. Understanding the implications of wealth tax, both for players and operators, is essential for ensuring legal compliance and maximizing profitability. As the online casino industry continues to grow, staying informed about these rules will be crucial for all stakeholders involved.

online games for cash prizes in india

India has witnessed a significant surge in the popularity of online gaming over the past few years, with millions of players engaging in various forms of virtual entertainment. One aspect that has gained considerable attention is online games that offer cash prizes to winners. In this article, we will delve into the world of online gaming for cash prizes in India, exploring its types, rules, and regulations.

Types of Online Games for Cash Prizes

Several types of online games in India offer cash prizes to players. Some of these include:

- Skill-based games: These are online games that require a certain level of skill or strategy to play. Examples include poker, rummy, and chess.

- Fantasy sports: This type of game involves creating virtual teams of real-life athletes and competing against other players based on the performance of their selected team members.

- Casino-style games: Online casinos in India offer various games like slots, blackjack, and roulette, where players can win cash prizes by chance.

Rules and Regulations

Online gaming for cash prizes in India is subject to certain rules and regulations. Some key points to consider include:

- Age restrictions: Most online gaming platforms require players to be at least 18 years old to participate.

- KYC (Know Your Customer) verification: Players may need to provide identification documents to verify their age and identity.

- Taxation: Winnings from online games are considered taxable income in India. Winners must report their winnings to the tax authorities.

Popular Online Gaming Platforms

Several popular online gaming platforms in India offer cash prizes to players. Some of these include:

- Paytm First Games: A leading online gaming platform that offers a wide range of games, including skill-based and fantasy sports.

- Adda 52: An online casino platform that provides various games like poker, blackjack, and roulette.

- Fantasy Power 11: A popular fantasy sports platform that allows players to create virtual teams and compete against other users.

Online gaming for cash prizes in India is a rapidly growing industry, with millions of players engaging in various forms of virtual entertainment. By understanding the types of games available, rules, and regulations, as well as popular online gaming platforms, players can make informed decisions about which games to play and how to participate safely.

Note: The content provided is for informational purposes only and should not be considered as legal or financial advice. Players are advised to research and understand the terms and conditions of each game before participating.

is 22bet legal in india

In recent years, online betting platforms have gained significant popularity worldwide, including in India. One such platform is 22Bet, which offers a wide range of sports betting options, casino games, and more. However, the legality of such platforms in India can be a bit confusing. This article aims to clarify whether 22Bet is legal in India.

Understanding the Legal Landscape

Indian Gambling Laws

- Public Gambling Act of 1867: This is the primary law governing gambling in India. It prohibits public gambling and the maintenance of common gaming houses. However, it does not explicitly mention online gambling.

- State-Level Regulations: Each state in India has the authority to formulate its own gambling laws. Some states have legalized certain forms of gambling, while others have strict prohibitions.

- Information Technology Act of 2000: This act deals with cyber activities and does not specifically address online gambling but provides a framework for regulating online activities.

Online Gambling in India

- No Central Law: There is no central law in India that specifically legalizes or prohibits online gambling. This leaves the interpretation and enforcement to individual states.

- Skill vs. Chance: Many online betting activities are considered legal if they involve a significant element of skill, as opposed to pure chance. This distinction is crucial in determining the legality of platforms like 22Bet.

22Bet’s Operations in India

Licensing and Regulation

- Offshore Licensing: 22Bet operates under licenses from jurisdictions like Curacao, which is a common practice among international online betting platforms.

- Compliance: 22Bet claims to comply with all relevant regulations and standards set by its licensing authorities.

User Experience

- Accessibility: Indian users can access 22Bet’s website and mobile app without any apparent restrictions.

- Payment Methods: 22Bet supports various Indian payment methods, including UPI, NetBanking, and popular cryptocurrencies, making it convenient for Indian users.

Legal Considerations for Indian Users

Risk of Prosecution

- State Laws: Users in states with strict gambling laws may face legal repercussions if caught using online betting platforms.

- Personal Responsibility: Users should be aware of the legal risks and act responsibly. It is advisable to check local laws before engaging in online betting activities.

Tax Implications

- Income Tax: Winnings from online betting are considered taxable income in India. Users are required to report their winnings and pay the appropriate taxes.

While 22Bet operates legally under its offshore licenses and is accessible to Indian users, the legality of using such platforms in India remains a gray area. Users should exercise caution and be aware of the potential legal and tax implications. Consulting with legal experts or checking local laws can provide further clarity on the matter.

Key Takeaways

- 22Bet operates under offshore licenses and is accessible in India.

- The legality of online gambling in India is not clearly defined by central laws.

- Users should be aware of local state laws and potential legal risks.

- Winnings from online betting are taxable in India.

By understanding these aspects, Indian users can make informed decisions about using platforms like 22Bet.

poker in goa

Note: This article will be written in a neutral tone and style, without taking any stance or promoting any particular agenda.

Goa, a tiny state located on the western coast of India, has been known for its vibrant casino scene and attractive tourist spots. Among various games available at casinos in Goa, poker has gained immense popularity over the years. In this article, we’ll delve into the world of poker in Goa, exploring its history, types of poker games, and what players can expect from a poker experience in this Indian state.

History of Poker in Goa

Poker was first introduced to Goa’s casinos around 2008-09 by international operators like Sikkim-based Dara Khalsa Foundation. These casinos initially offered only Texas Hold’em variants but eventually expanded their game offerings, making poker a staple at most casino tables.

As the popularity of poker grew, so did its accessibility in Goa. Today, players can choose from various types of poker games and participate in tournaments with varying buy-ins. Poker rooms at casinos have been upgraded to cater to increasing demand, featuring comfortable seating, state-of-the-art equipment, and an atmosphere conducive to serious gaming.

Regulations and Taxes

The Gaming (Amendment) Act 2010 governs casino operations, including poker games, in the state of Goa. As a result, all online and offline poker rooms are required to be licensed by the government. Poker operators must follow strict guidelines to ensure fairness, security, and transparency for players.

While there’s no specific tax imposed on winnings from poker games in Goa, individual income taxes apply as per Indian Income Tax laws. Winnings from gaming activities are treated as taxable income unless claimed under Section 54 (exempting income earned from winnings that can be proved to have been derived entirely from winning).

Types of Poker Games

Poker enthusiasts visiting Goa will find several types of poker games being offered at various casinos and online platforms:

Texas Hold’em

Most popular among visitors, Texas Hold’em is a community card game where players receive two private cards (hole cards) and five shared community cards. It’s available in variants such as Limit, No-Limit, and Pot-Limit.

Omaha Poker

Another well-known variant of poker, Omaha features four personal hole cards and five shared community cards. Players must use exactly two of their hole cards to make a hand.

Casino Hold’em

A more modern take on the classic game, Casino Hold’em uses a special electronic table for faster gameplay and is often played with lower stakes than traditional tables.

Poker Experience in Goa

Poker enthusiasts will appreciate Goa’s poker scene due to its:

- Variety of Games: Casinos offer various forms of poker games for players who prefer different formats or betting styles.

- Friendly Atmosphere: The laid-back atmosphere at casinos contributes significantly to the overall gaming experience, making it more enjoyable and social.

- Professional Staff: Poker tables are manned by trained dealers and floor staff, ensuring a smooth game flow and fair conduct of play.

While poker has become increasingly popular in Goa, there are concerns about the potential risks associated with excessive gambling. Players are advised to approach gaming responsibly and within their means, respecting the laws of India regarding income tax on winnings.

In conclusion, poker in Goa offers an exciting experience for those who love playing card games. With its rich history, diverse range of games, and well-regulated environment, Goa has become a hub for serious poker enthusiasts.

Frequently Questions

What are the business game rules for wealth tax in India, particularly for online casinos in Mumbai?

In India, the business game rules for wealth tax, including for online casinos in Mumbai, are governed by the Wealth Tax Act of 1957. This act was repealed in 2016, and wealth tax was subsumed under the Income Tax Act. Currently, wealth tax is not applicable, but online casinos must adhere to income tax regulations. Operators must declare their income from online gambling and pay taxes accordingly. Additionally, they must comply with local regulations and obtain necessary licenses. For precise details, consulting a tax expert or referring to the latest Income Tax Act provisions is advisable.

How do wealth tax rules apply to business games in India, especially for online casinos in Mumbai?

In India, wealth tax rules apply to business games, including online casinos in Mumbai, by assessing the net wealth of individuals and businesses. The Wealth Tax Act of 1957 imposes a tax on the net wealth exceeding a specified threshold. For online casinos, this involves calculating the value of assets, including business holdings, less allowable deductions. Mumbai, being a financial hub, ensures strict compliance with these regulations. Operators must maintain accurate records and file timely returns to avoid penalties. Understanding these rules is crucial for legal operations and financial planning in the gaming industry.

How does winning a jackpot in an Indian casino affect you?

Winning a jackpot in an Indian casino can significantly impact your life. Financially, it provides a substantial sum that can cover debts, invest in property, or start a business. Emotionally, it can bring joy and relief, but also stress from managing a large sum. Socially, it may alter relationships, both positively and negatively, as people react differently to sudden wealth. Tax implications are crucial; in India, gambling winnings are taxable, so professional advice is essential. Overall, while a jackpot offers new opportunities, it also demands careful planning and responsible management to ensure long-term benefits.

What is the comprehensive online casino wiki?

The comprehensive online casino wiki is an extensive, user-friendly resource designed to provide detailed information about online casinos, games, strategies, and industry news. It covers a wide range of topics including game rules, bonuses, payment methods, and responsible gambling. This wiki aims to educate both beginners and experienced players, offering insights into the best practices and latest trends in the online gambling world. By consolidating a wealth of knowledge, it serves as a one-stop guide for anyone interested in the online casino experience, ensuring they have the information needed to make informed decisions and enhance their gaming experience.

How to Play Andar Bahar Slots Game in Hindi?

Andar Bahar slots game खेलने के लिए, सबसे पहले एक विश्वसनीय ऑनलाइन कैसीनो में जाएं जो हिंदी में उपलब्ध हो। खाता बनाएं और जमा करें। गेम खोजें और 'Andar Bahar' चुनें। एक कार्ड खींचें और 'Andar' या 'Bahar' में से एक पर शर्त लगाएं। यदि आपकी शर्त जीतती है, आपको भुगतान मिलेगा। हिंदी में निर्देशों का पालन करें और गेम का आनंद लें। ध्यान रखें कि जुआ में जोखिम होता है, इसलिए जिम्मेदारी से खेलें।